What is a fixed index annuity?

What is a fixed index universal life (FIUL) policy?

What happens after you apply for life insurance?

Ask me anything: Is it true that people don't want to talk about money?

Start Making Cents – Getting started

Start Making Cents – Start Early

Start Making Cents – Stay Patient

Contact Us

Lemmond Financial

Steve Lemmond

Address: 101 S. Coit Ste. 36-316 Richardson TX, 75080

Phone: 214-729-8020

E-Mail: [email protected]

Home \ Personal Finance \ Establishing a Budget

Establishing a Budget

Many of us fail to see the relationship between budgeting and saving. Budgeting is a process that starts by setting spending targets that help us to stay within our means of paying the bills. Living without a budget is one thing, living beyond our means is another. If, at the end of the month, you have no money left, how can you save for retirement, or anything else? It would be helpful to develop a budget, in order to help us stay within our means. A personal budget is useful in controlling personal expenses, and saving for retirement.

Reasons for having a personal budget usually change over time, but as we know, the sooner we begin to save, or invest wisely, the better off we will be. When we are in our 20s, we may focus on repaying debts or saving for a down payment on a home, and put off saving for retirement. We may want to set a budget that will help us to set aside several thousand dollars for a vacation. When we are in our 30s and 40s, budgeting is important to help pay for our children’s living and college expenses, but we should also save for retirement. By the time we enter our 50s, saving for retirement becomes a major financial goal. In reality, you should begin to save for retirement as soon as you begin to earn a paycheck, whether you are employed by a major corporation, small business,

Budgeting, as well as a disciplined savings or investment program, is the cornerstone to managing all of our responsibilities. No personal budget often means an inability, or unwillingness, to identify a potential source of regular savings. Think about that. A personal budget will impose some discipline on adhering to a savings plan.

Some important steps in setting up a personal budget include:

Select a period to measure. A monthly budget often works best. Most of us pay our rent, mortgage, and utility bills monthly. It is also the period over which many of us get paid. If you are paid every two weeks, you can add the amounts to determine a monthly figure.

Calculate net cash flow for the period. Your personal net cash flow subtracts your cash expenses (cash outflows) from you cash income (cash inflows). If you charge with your credit card, add those charges to your cash expenses. Using your credit card is only a means of postponing cash outflows.

Keep records. Accurate records will help you to keep a history of several budgeting periods. You can string together 12 months of budgets to create an annual budget. You can use your budget records to compare actual and budgeted spending. The differences in actual and budgeted spending are called variances. Be as precise in your record keeping as you can afford to be.

Monitor and Review. Your records help you to compare how well you budget. The key is to identify positive budget variances where your actual cash outflows are less than your budgeted cash outflows. These variances are a source of funds to save and invest. For example, if you budget $1,500 in monthly cash outflows but routinely only have cash outflows of $1,400, you have identified a source of savings worth $100 a month.

Save for an emergency fund. As you gradually find you can save each month, you may want to first set aside enough for an emergency fund. An emergency fund consists of three to six months of savings. An emergency fund is also called a rainy-day fund and should be used only to pay for unanticipated financial setbacks. These setbacks may include losing a job, becoming ill, or suffering the death of a family member.

Save and/or Invest regularly. A personal budget may have led you to identify a way to save $100 a month. Saving or investing this extra $100 every month lets you take advantage of compound interest.

Since your emergency fund serves a vital purpose, you want to have access to the funds. An effective technique for managing your emergency fund is laddering. First, you divide your savings into roughly equal amounts. Next, you deposit these amounts in short-term CDs of different maturities. The length of maturity terms should be spaced at intervals that don’t jeopardize your access to at least some of your emergency fund at any given time.

For example, you may wish to divide $4,000 of a $5,000 fund into four equal parts, keeping $1,000 in an account you can access immediately. Next, you may consider investing $1,000 each in a 3, 6, 9, and 12-month CD. As each CD matures, you extend, or roll over, the CD for one year. This allows you to establish a stream of CDs that mature every three months. If you ever need more than $1,000 of your fund, the longest you would have to wait (unless you paid a fee for early redemption) would be three months.

Personal Cash Flow

If you take the time to set up a personal budget, you are likely to identify ways to improve your cash flow. Your personal cash flow is the mathematical difference of your cash inflows, such as your paycheck, savings and investment income, rental property income, etc, and cash outflows, mortgage payments, auto payments, insurance, groceries, gasoline, etc.

In order to calculate your personal cash flow, start by selecting a period of time for measuring your cash inflows and your cash outflows. A month is the most common period used, as most bills are paid on a monthly basis. Today, most people get paid bi-weekly or weekly. If you get paid more frequently than monthly, you can multiply by 2 (if paid either twice a month or every two weeks), or by 4 (if paid weekly), to approximate your cash inflows from your employment on a monthly basis.

Next, add up your monthly cash inflows. Be sure to add other income that you receive in cash. Include only those cash inflows that are received on a regular basis. If you do not earn the income consistently, leave it out.

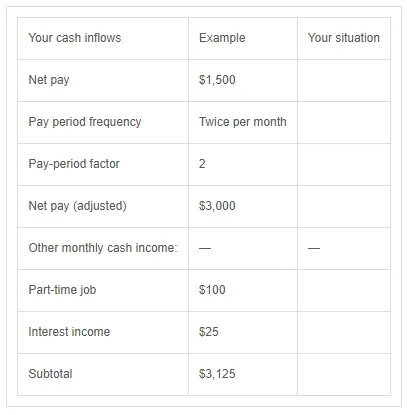

Use your net income, which deducts retirement-plan contributions, income taxes, and Social Security taxes. Add up all cash inflows to calculate a subtotal. The following worksheet shows an example:

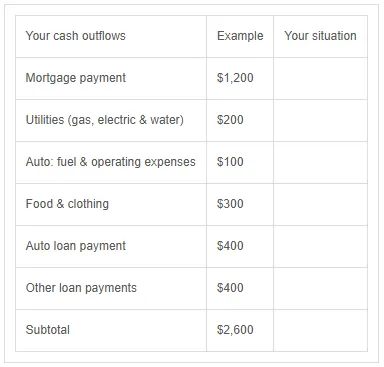

Next, calculate your cash outflows on a monthly basis. Add up your bills that you pay on a regular basis. (The example assumes that you pay your bills once a month.) At a minimum, your monthly bills include mortgage or rent payment, utilities, fuel and transportation expenses, and food. If you make other loan or credit card payments, add those to the outflows too.

Children’s school and living expenses, on a monthly basis, should also be included. Add up all cash outflows to calculate a subtotal. The following worksheet shows an example:

Finally, subtract your cash outflows from your cash inflows. This difference is your personal net cash flow. In this example, personal cash flow is equal to $525 ($3,125-$2,600). This is money you can save and invest.

By calculating your personal cash flow, you can identify opportunities to save. You can improve your cash flow by either increasing your inflow or reducing your outflow, and discover you really can save more toward your retirement, and budget your way to a significant nest egg.

This page includes a few very specific steps for individuals to take in regard to their own budget. Everyone’s situation is different. We would suggest that consumers discuss their own situation with their own financial professional.

"I'm more concerned about the return OF my money than the return ON my money."

~Will Rodgers