What is a fixed index annuity?

What is a fixed index universal life (FIUL) policy?

What happens after you apply for life insurance?

Ask me anything: Is it true that people don't want to talk about money?

Start Making Cents – Getting started

Start Making Cents – Start Early

Start Making Cents – Stay Patient

Contact Us

Lemmond Financial

Steve Lemmond

Address: 101 S. Coit Ste. 36-316 Richardson TX, 75080

Phone: 214-729-8020

E-Mail: [email protected]

Home \ Personal Finance \ Elder Care Planning

Elder Care Planning

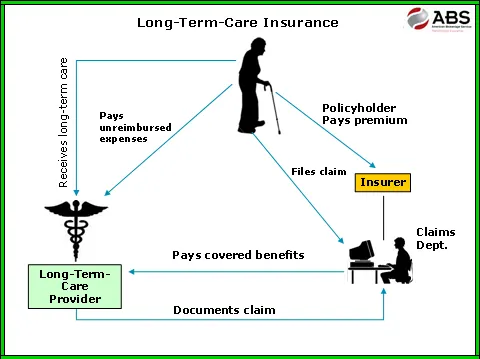

Insuring the need for care in a nursing home or assisted living facility, is made possible through the purchase of a long-term care insurance policy, or through the purchase of universal life insurance with a long-term care rider.

Long-Term care insurance

As the number of Americans entering retirement increases sharply over the next 20 years, long-term care insurance is a popular topic of conversation. Today, many people choose to buy long-term care insurance or universal life insurance with a long-term care rider, an alternative product to traditional long-term care insurance. Long-term care insurance will provide, via your policy, the financial capacity in the form of daily benefits, or in the case of universal life insurance with a long-term care rider, an advance of the death benefit, should you become unable to perform basic activities of daily living, referred to commonly as (ADLs).

Important Features to look for in a long-term care policy include:

Maximum periodic benefits. Maximum periodic benefits are the total amount of benefits the insurer pays during a prescribed period.

Maximum lifetime benefits. Maximum lifetime benefits are the total amount of benefits the insurer pays over the lifetime of the policyholder.

Applicable services. Check what level of care is provided in the policy. Some policies will pay for skilled care, while other policies may also pay benefits forpersonal care, commonly referred to as “home health care”.

Applicable points of service. Some policies will pay for care provided only in a licensed facility, while others may also pay for home-based care.

Inflation protection. A long-term care policy with inflation-protected features may help to shield you from health care costs that tend to rise at a faster rate than the general rate of inflation. Be mindful that there is a cost to this extra protection, commonly referred to as a COLA rider.

Cost of premiums. A long-term care insurance policy may cost thousands of dollars a year in premiums. According to the National Association of Insurance Commissioners (NAIC), long-term care insurance premiums cost about two times as much at age 65 as they do at 50. At 75, premiums cost about seven times as much as for a 50-year-old person. Be aware that the premiums of long-term care policies may be guaranteed, or subject to annual increases.

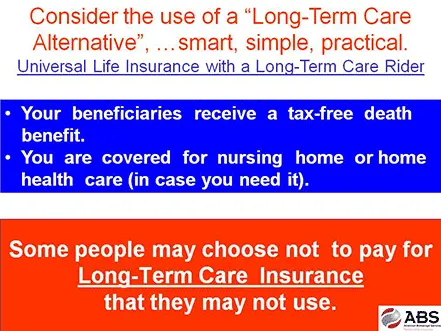

Consider “Alternatives” to long-term care insurance.

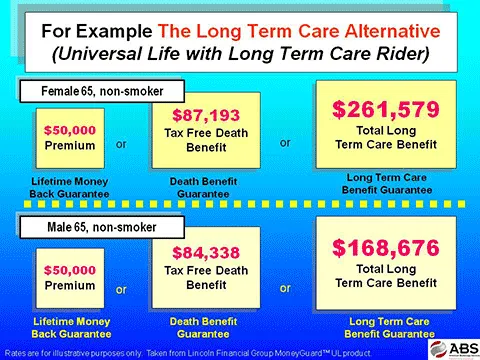

Consider the use of a Long-Term care alternative – Universal Life Insurance with a Long-Term Care Rider.

Why would a Universal Life Insurance policy serve as an alternative to Long-Term Care Insurance?The answer is;

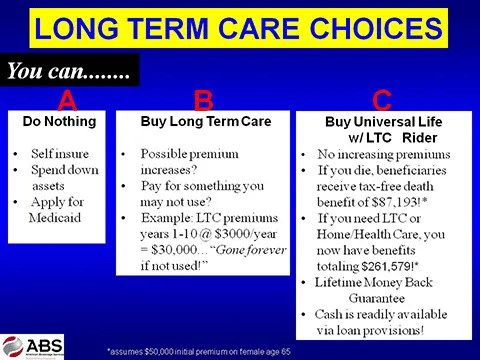

Consider your overall LONG TERM CARE CHOICES

A)Do Nothing

Self-insure

Spend down assets

Apply for Medicaid

B) Buy Long Term Care

A long term care policy will provide you peace of mind, however, the money spent on LTC premiums is gone forever if the long term care policy not used! *Some newer contracts offer “return of premium” riders

C) Buy Universal Life with LTC Rider

Universal Life Insurance with a long term care rider may not be ideal for you. However, it is a choice that is often overlooked. Consider whether or not Universal Life Insurance with a long term care rider is appropriate for your particular situation.

Consider also, if you are living entirely off Social Security, you may be able to qualify for the Medicaid program for long-term care, provided you pass a “means test”. A means test is administered by the Social Security Administration to determine if the amount of income and assets that you own are enough to pay for the cost of a service that a federal program such as Medicaid would otherwise pay for.

Today, some employer benefit packages include a group policy for long-term care insurance. With a group policy, you may find long-term care premiums to be less than individual policies, and you may be less likely to face as rigorous a health condition questionnaire as you may for an individual policy.

Consider the following issues when choosing long-term care insurance policies:

The above information is educational and should not be interpreted as financial advice. For advice that is specific to your circumstances, you should consult a financial or tax adviser.

"I'm more concerned about the return OF my money than the return ON my money."

~Will Rodgers